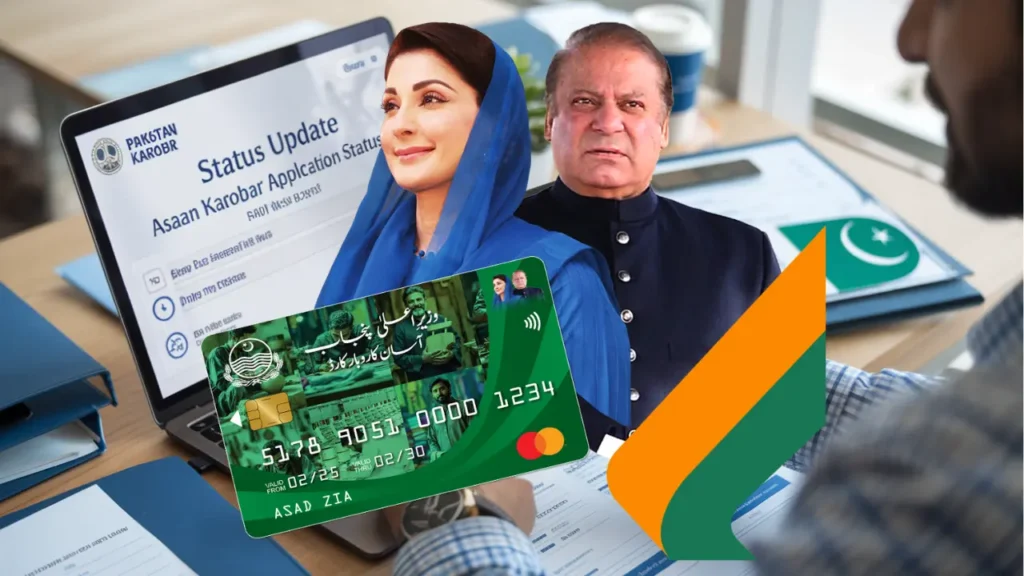

Asaan Karobar is a government program in Pakistan. It aims to make business registration easier and offer loans to small businesses. For those applying, knowing the business loan application status is key. This guide will show you how to use the application tracking system to check your asaan karobar status check easily.

Key Takeaways

- Asaan Karobar helps businesses access loans and streamline regulatory processes.

- Tracking your business loan application status reduces uncertainty during the approval process.

- The application tracking system offers real-time updates on your asaan karobar status check.

- Timely tracking ensures you can address issues early and meet deadlines.

- Understanding your application status helps plan business operations effectively.

Understanding the Asaan Karobar Program

The asaan karobar program details show a government-backed plan to help pakistan small business program members. It started in 2020 to help SMEs get loans and make rules simpler. The Punjab Small Industries Corporation (PICS) runs it, helping those who can’t get bank loans.

What is Asaan Karobar?

This pakistan small business program gives loans up to PKR 3 million with easy payback plans. The PICS website says, “A digital-first approach cuts down on red tape for small businesses.”

“Digital-first approach reduces red tape for small businesses,”

It focuses on areas like making things, textiles, and farming. This helps Pakistan grow its economy.

Eligibility Requirements for Small Business Loans

- Business registered in Punjab for at least 1 year

- Valid CNIC, business license, and bank statements

- Business turnover under PKR 15 million annually

- No pending loans or legal disputes

The Application Process Overview

Here’s how to apply:

- Register online via the official portal

- Upload required documents (PDF format only)

- Attend a mandatory orientation session

- Receive a preliminary approval notice

After applying, you can check your status online. It usually takes 2-4 weeks, but can be longer during busy times. Keeping businesses updated is important.

How to Check Asaan Karobar Application Status

For expatriates and domestic applicants, asaan karobar tracking offers several ways to check your asaan karobar loan application. Start by visiting the official portal: assaankarobar.gov.pk. Use your registered login to access your dashboard. There, you can see if your application is “Approved” or “Under Review.”

- Online Portal: Check your account for the latest updates. Look for messages like “Additional Documentation Required” to know what to do next.

- SMS Service: Send “STATUS [Application ID]” to 8300 for quick SMS updates.

- Helpline: Call 051-9053333 (toll-free from Pakistan) or +92-51-9053333 globally. The operators can help with asaan karobar eligibility verification questions.

- In-Person: Visit any National Bank of Pakistan branch with your CNIC to confirm your status.

“Always keep your application ID and CNIC handy for quick inquiries,” advises a program official.

If your status seems off, first check it via two methods. For missing documents, upload them again through the portal under “Uploads.” If your asaan karobar loan application is still pending, contact support with your reference number. Make sure all your details match your NADRA records to avoid delays.

Regularly checking through these channels keeps you informed about loan approval timelines. Being proactive helps solve issues early and prevents delays.

Conclusion

Tracking your small business loan status regularly is important. It keeps you updated on your application’s progress. Using the asaan karobar status check tools helps avoid delays and keeps you on track.

Keeping your records organized and having reference numbers ready makes communication smoother. This reduces the chance of mistakes.

After your application is decided, approved businesses need to get ready for the funds. They should look at disbursement timelines and follow guidelines. Businesses that are not approved can appeal or look for other financing options on the Asaan Karobar portal.

It’s crucial to have clear documents and follow up on time during asaan karobar tracking.

Business owners should also keep an eye on the Asaan Karobar website and sign up for email alerts. The Small Business Administration (SBA) website has more resources for managing loans and following rules. Being proactive helps you meet the program’s needs better.

Whether you’re waiting for approval or planning what to do next, staying informed is key. The Asaan Karobar program offers support, and financial advisors can help with plans. Keeping in touch with program officers keeps things clear and open.

FAQ

What is the Asaan Karobar program?

The Asaan Karobar program is a government effort in Pakistan. It aims to help small and medium enterprises (SMEs) grow. It offers loans to support businesses and boost the economy.

Who is eligible to apply for Asaan Karobar loans?

To get an Asaan Karobar loan, businesses must meet certain criteria. They need to be small or medium-sized. They also need to have the right documents and a good financial history.

How can I check the status of my Asaan Karobar application?

You can check your application status online. Just log in with your application ID. You can also get updates by SMS, call helplines, or visit government offices or banks.

What do different application status messages mean?

Status updates can tell you what’s happening with your application. “Under Review” means it’s being checked. “Additional Documentation Required” means you need to send more info. “Approved” means you got the loan. “Disbursement in Process” means the money is being sent.

What should I do if I encounter issues with my application?

If you have problems like a lost application ID or website issues, call customer support. They can help with any status discrepancies too.

How long does the application process typically take?

The time it takes to process applications can vary. It depends on how many applications there are and the details of each case. Usually, you’ll get updates in a few weeks, but it might take longer if more info is needed.

Are there any alternative funding options if my application is declined?

Yes, if you’re not approved for an Asaan Karobar loan, there are other options. You could try microfinance, venture capital, crowdfunding, or local grants for small businesses.

How can I stay organized during the application process?

To stay organized, keep all your documents in one spot. Track your application numbers and set reminders. Keep records of all your communications. This makes the process smoother and helps you avoid missing anything important.