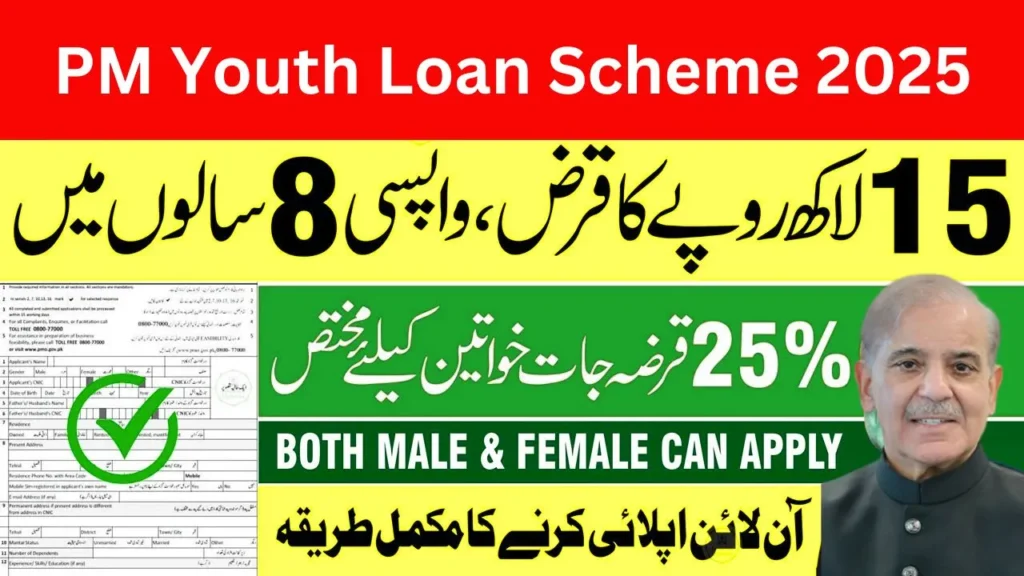

In 2025, the Government of Pakistan has once again taken a commendable step to empower its citizens, particularly the unemployed youth, by launching the Prime Minister Youth Loan Scheme 2025. This initiative offers financial support of up to PKR 7.5 million to aspiring entrepreneurs and small business owners who wish to start or expand their businesses.

Let’s dive into the details and learn how you can benefit from this scheme, who is eligible, and how to apply—step by step.

What is the PM Youth Loan Scheme?

The Prime Minister Youth Loan Scheme is a government-backed initiative aimed at reducing unemployment and promoting entrepreneurship across Pakistan. This scheme is open to both men and women from all provinces, including AJK and Gilgit-Baltistan.

The loan is repayable in easy monthly installments over 8 years, and the first 6 months are entirely interest-free, giving new businesses time to establish themselves before repayments begin.

Loan Categories: Tier-Based System

The scheme is divided into three tiers based on the loan amount:

| Tier | Loan Range | Interest Rate |

|---|---|---|

| Tier 1 | Up to PKR 500,000 | 0% (Interest-Free) |

| Tier 2 | PKR 500,001 – PKR 1,500,000 | 5% Annual |

| Tier 3 | PKR 1,500,001 – PKR 7,500,000 | 7% Annual |

The focus of this article is on Tier 2, where individuals can apply for loans between PKR 500,001 and PKR 1.5 million.

Key Features of the Scheme

- Loan Amount: Up to PKR 7.5 million (depending on the tier)

- Repayment Tenure: 8 years (96 months)

- Grace Period: First 6 months – no repayment required

- Collateral: Depending on the loan size and bank requirements

- Application Mode: Entirely online – no physical documents required

Who Can Apply?

✅ Eligible Individuals:

- Pakistani nationals with a valid CNIC

- Residents of any province or territory in Pakistan

- Individuals aged 21–45 (18+ for IT/e-commerce sectors)

- Those looking to start a new business or expand an existing one

❌ Not Eligible:

- Government employees

- Overseas Pakistanis (non-residents)

Note: There is no specific education requirement. Even primary or middle-pass individuals can apply.

Participating Banks

Loans under this scheme are disbursed through the following major banks:

- Bank of Punjab (BOP)

- National Bank of Pakistan (NBP)

- Askari Bank

- Habib Bank Limited (HBL)

- Bank of Khyber

Among these, BOP, NBP, and Askari Bank are often recommended due to better user experience and faster processing.

How to Apply for the PM Youth Loan Scheme

Step 1: Visit the Official Website

Head over to the official portal: 👉 https://pmyp.gov.pk

Step 2: Use the Loan Calculator (Recommended)

Before applying, use the built-in loan calculator to estimate your:

- Monthly installment

- Total interest

- Full repayment amount

💡 Example: If you borrow PKR 1,000,000 for 8 years (under Tier 2 at 5% interest), your:

- Monthly installment ≈ PKR 12,660

- Total repayment ≈ PKR 1,215,352 (including markup)

- First 6 months: No payment required

Step 3: Start the Application

Click on “Apply for Loan” and begin the 9-step application process.

You will need to provide:

- CNIC number and issuance date

- Select loan tier (e.g., Tier 2 for PKR 500,001 – 1,500,000)

- Personal, business, and financial details

- Select a bank for loan processing

- Upload relevant documents (e.g., business plan, CNIC image)

Each field marked with an asterisk (*) is mandatory.

Important Tips Before You Apply

- ✅ Ensure your CNIC is valid and up to date

- ✅ Prepare a basic business plan or idea

- ✅ Choose a reliable bank with good customer service

- ✅ Be honest and accurate in all your application details

- ✅ Double-check all entries before submission

Tracking Your Application

After submission, you can track your application’s status by clicking on “Track Application” on the PMYBALS homepage using your CNIC and mobile number.

Final Words

The PM Youth Loan Scheme 2025 is a golden opportunity for motivated individuals who have business ideas but lack the funds to turn them into reality. With a simple online application process, interest-free grace period, and support from major Pakistani banks, this initiative has the potential to reshape many lives and communities.

Take the first step today — plan smartly, apply correctly, and build your future with confidence.

Frequently Asked Questions (FAQs)

Is collateral required?

Depending on the loan amount and bank policies, you may be required to offer some form of security.

Can students apply?

Yes, as long as they meet the age and CNIC requirements and have a valid business idea.

Can a person with an existing business apply?

Yes, the scheme is open to those who want to expand their existing business too.