The CM Punjab Maryam Nawaz has launched the Aasaan Karobar Loan Schemes, a groundbreaking interest-free loan scheme designed to support aspiring entrepreneurs and small business owners. Under this scheme, individuals can avail of loans ranging from PKR 100,000 to PKR 30 million with easy repayment plans spanning 3 to 4 years. This initiative aims to foster economic growth by providing accessible financial assistance to businesses across Punjab.

وزیر اعلیٰ پنجاب مریم نواز نے آسان کاروبار لون اسکیم متعارف کرائی ہے، جو ایک انقلابی بغیر سود قرضہ اسکیم ہے، جس کا مقصد نئے کاروباری افراد اور چھوٹے کاروباری مالکان کی مدد کرنا ہے۔ اس اسکیم کے تحت افراد 1 لاکھ روپے سے 3 کروڑ روپے تک کے قرض حاصل کر سکتے ہیں، جن کی ادائیگی 3 سے 4 سال کے آسان اقساط میں کی جا سکتی ہے۔ یہ اقدام پنجاب بھر میں کاروباری ترقی کو فروغ دینے کے لیے مالی مدد کو قابلِ رسائی بنانے کے لیے اٹھایا گیا ہے۔

In this guide, we will walk you through the entire application process, required documents, eligibility criteria, and the latest updates on how to apply for the Maryam Nawaz Loan Scheme 2025 from the comfort of your home.

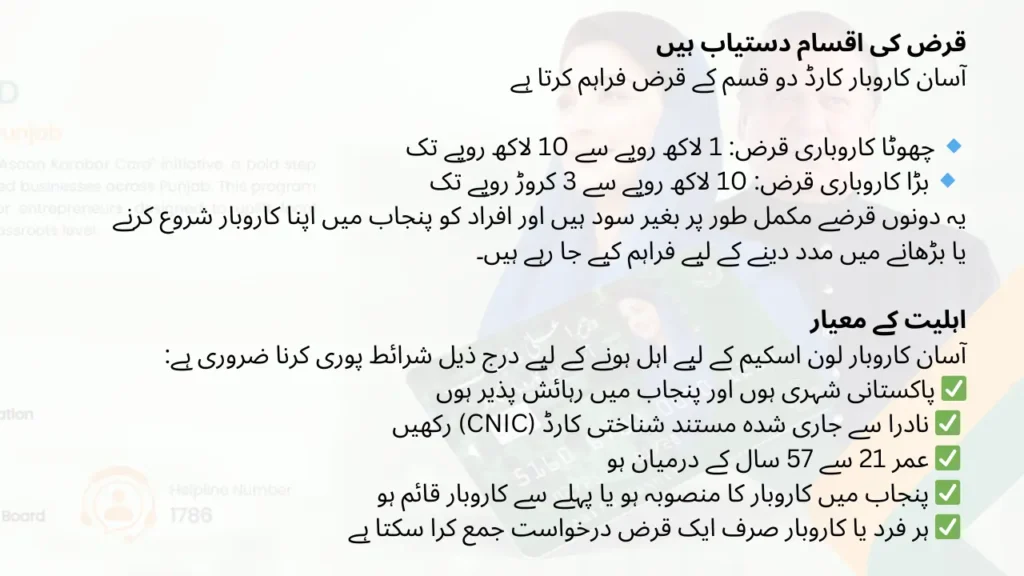

Types of Loans Available

The Aasan Karobar Card offers two loan categories:

- Small Business Loan: PKR 100,000 to PKR 1,000,000

- Large Business Loan: PKR 1,000,000 to PKR 30,000,000

Both loans are completely interest-free and are aimed at helping individuals establish or expand their businesses in Punjab.

Eligibility Criteria

To qualify for this scheme, you must meet the following requirements:

- Be a Pakistani citizen residing in Punjab

- Hold a valid CNIC (Computerized National Identity Card) registered with NADRA

- Age between 21 and 57 years

- Have a business setup or plan within Punjab

- Only one loan application per individual or business is allowed

Step-by-Step Guide to Apply

You can apply for the loan online without visiting any office. Here’s how:

Step 1: Visit the Official Website

- Open Google and search for Aasan Karobar Card.

- Click on the official website link that appears in the search results.

Step 2: Register Yourself

- Click on the Apply for Aasan Karobar Card option.

- Read the provided instructions carefully before proceeding.

- Ensure you have a CNIC-registered mobile number for verification.

Step 3: Fill in Personal Details

- Enter your full name (as per CNIC).

- Provide your father’s or husband’s name (for female applicants).

- Input your CNIC number, date of birth, and CNIC issuance and expiry date.

- Select your mobile network and enter your registered phone number.

- Create a strong password and click Register.

Step 4: Log in to Your Account

- Use your CNIC number and password to log in.

- Navigate to the application portal to proceed further.

Step 5: Provide Business Details

- Select your business type (Proprietorship, Partnership, or Private Limited Company).

- Enter details about your business location (division, district, city, tehsil).

- Specify the ownership status of your business property (rented, owned, family-owned).

- Indicate the number of dependents you support.

- Provide details about your education level and professional experience.

Step 6: Loan Amount & Purpose

- Choose the loan amount required (from PKR 100,000 to PKR 10,000,000).

- State the purpose of the loan, such as business expansion, equipment purchase, or working capital.

Step 7: Upload Required Documents

To complete your application, you must upload the following documents:

- Front and back scan of your CNIC

- Business registration certificate (if applicable)

- Proof of residence (utility bill or rental agreement)

- Business account statement (last 1-2 years, if applicable)

- Tax registration number (if applicable)

- Any other supporting business documents

Step 8: Submit and Verify OTP

- After filling in all details, click Submit.

- You will receive a One-Time Password (OTP) on your registered mobile number.

- Enter the OTP for final verification.

- Once verified, your application is successfully submitted.

Loan Approval & Disbursement Process

- After submission, your application will be reviewed by authorities.

- If approved, funds will be transferred to your business account within a few weeks.

- You will receive a confirmation SMS regarding the loan approval and disbursement schedule.

Important Notes

- Ensure that all details provided are accurate to avoid rejection.

- Only one application per CNIC is allowed.

- This scheme is only for Punjab residents.

- If you need assistance, you can visit designated banks or government offices facilitating this loan program.

Conclusion

The Maryam Nawaz Loan Scheme 2025 through the Aasan Karobar Card is an excellent opportunity for entrepreneurs in Punjab to start or expand their businesses. With an interest-free structure and easy repayment options, it provides the financial support many businesses need. Follow the steps above carefully, ensure all documentation is correct, and take advantage of this initiative to achieve your entrepreneurial goals.

For the latest updates, keep checking the official website and stay informed about any new changes in the application process. Best of luck with your business journey!

Very nice